Globally diversified, whole of market, multi-asset portfolios

Our systematic investment approach combines our long-term macroeconomic views with rigorous data analysis

Analyse Asset Class Suitability

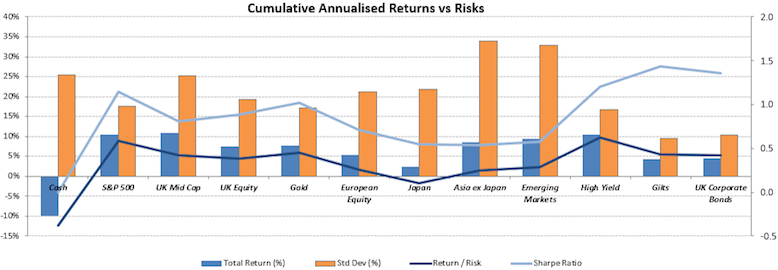

Identify suitable asset classes given our assessments of their expected risks and returns.

In carrying out this assessment, we exclude certain asset classes where lack of data and/or transparency is not compensated by potential returns.

Our Investment Committee reviews our investable universe on a quarterly basis.

Optimise Asset Allocation

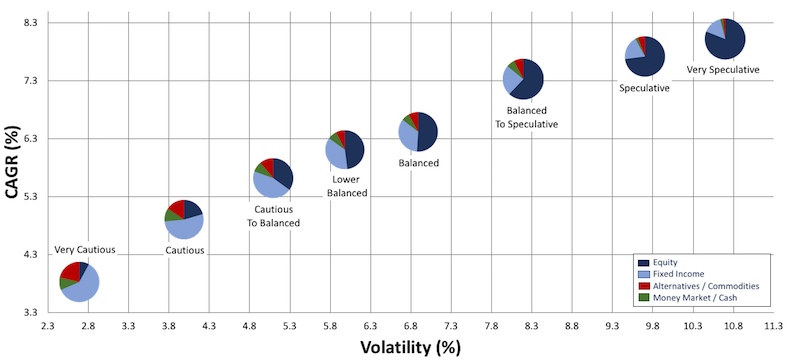

We develop optimal asset allocations based on modern portfolio theory to create stable, mean-variance efficient portfolios that match the client’s attitude to risk.

We use volatilities and correlations from historical data on a representative index for each asset class, along with expected returns and volatilities, and various economic indicators to drive the asset allocation.

Diversification is key and enforce a minimum and maximum allocation for each asset class to ensure better portfolio diversification.

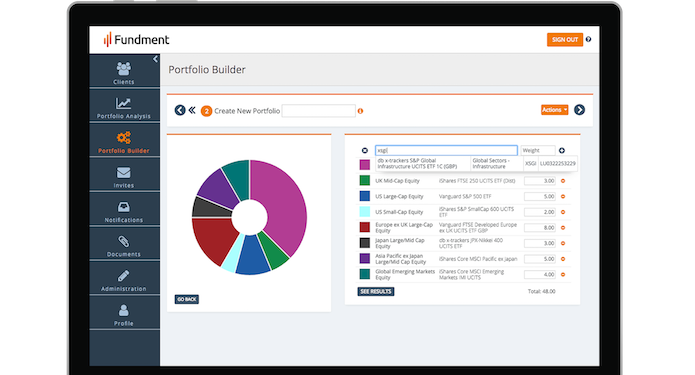

Select Appropriate Funds

We leverage the best of actively managed and passively managed funds to execute the asset allocation. We are whole-of-market in our approach and draw our investable funds from across the entire market.

We are guided by these principles when we select funds to include in client portfolios:

- Must be suitable for the client and meet their needs.

- Must be generally available to retail investors.

- Underlying securities must be transparent and liquid.

- We balance expected returns against costs in to ensure optimum value for clients.

Oversight by Investment Committee

Our Investment Committee brings decades of investment management experience to our investment process.

It includes industry experts outside of Fundment whose remits include quarterly review of portfolio positioning and asset allocation.

Effective Risk Profiling & Capacity for Loss

With a joined-up platform, Fundment provides both the tool to determine attitude to risk and capacity for loss of each client and maps them to a suitable portfolio. We eliminate the suitability gap from differing risk rating methodologies between investment managers and advisers.

Our platform ensures ongoing suitability by providing annual risk assessment follow ups and notifying the adviser and investment team of any changes required for the client.

Ready to optimise your practice with Fundment?

Our team will show you how our technology can take your business to the next level.